Modeling terminal L1 token value in a future with infinite blockspace

May 29, 2024

The investment case for blockspace is simple: it's globe-scale compute with interdependent state and premium pricing; aka cloud compute with network effects. Aided further by its capital intensity and ETH's expensive fee anchoring, blockspace has been the most investable on-chain business model in crypto, with the seven most well-funded post-ICO L1s raising an average of $425m each (so far).

Much of the financial interest in blockspace is based on an equity-adjacent model where transaction fees equate to revenue and burn (as a portion of transaction fees) equates to margin. While I, too, think that blockspace can be a great business, this model incorrectly assumes that 1) value must be intermediated by the protocol in order to accrue to the token and 2) deflation is the only way to generate terminal token value.

As a consequence, the Equity Model excludes the sale of relative execution (priority fees + MEV) in token value accrual and concludes that Layer 1s need some compute-scarcity premium on transaction fees to power token value accrual. Obviously, networks that are willing and able to scale compute in line with demand cannot have compute-scarcity fee premiums, so what does L1 token value accrual look like in a future with infinite blockspace?

Here, I argue that the correct place to look for terminal token value is not protocol value capture, but validator profitability. Since benign MEV is and will remain proportional to both transaction volume and TVL, as we inch closer to a future with huge TVL and increasingly commodified blockspace, networks should look to rely more and more on MEV as a source of validator profitability.

Good models make good decisions

Financial models are arguments about how value flows related to an asset affect its intrinsic value.

Up until the 1960s, investors relied on the dividend discount model to price equities. The DDM maps equity value to the sum of future dividends (discounted for risk + time), inheriting much of its reasoning from debt and prioritizing cash-in-hand for investors over company growth.

This turned out to be the wrong model, since 1) the best companies have nearly unlimited capacity to reinvest in growth and 2) it's more tax-efficient to bury free cash flow in expenses and generate new value within a company than leak it out as dividends.

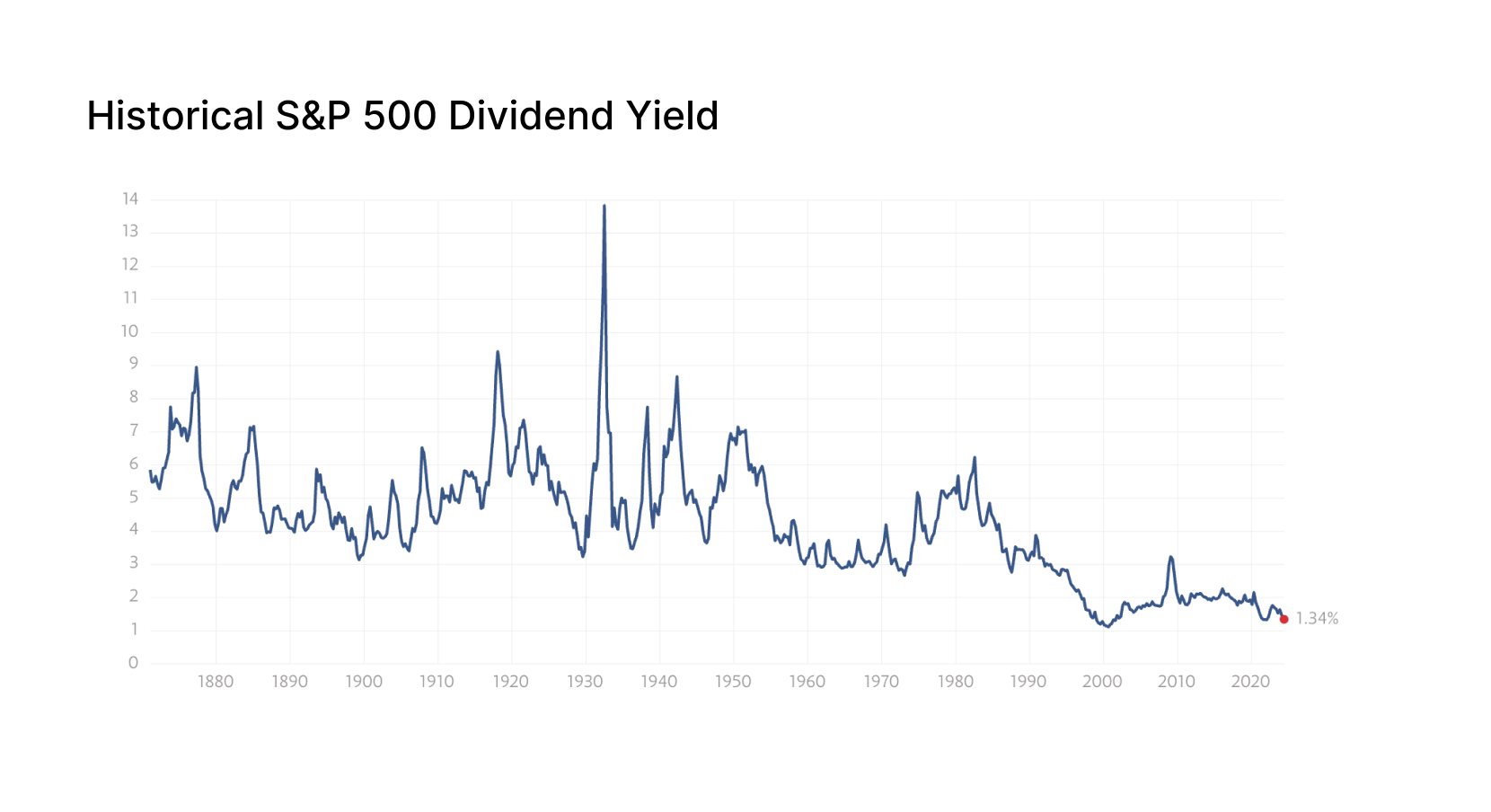

The DDM inherented an arbitrary bit of logic from debt—that cash returned is always more valuable than cash retained—causing several decades of misallocation. From 1870-1950, the average dividend yield paid out by the S&P 500 was 5.4%. Between 2000 and 2024, it was 1.8%.

Investors have conformed to lower dividends and greater reinvestment in growth/tech over time

Like general scientific models, financial models have correctness with respect to their ability to fully and accurately reflect reality. Better financial models more closely reward products according to their true value, helping investors and builders stay focused on things that actually matter.

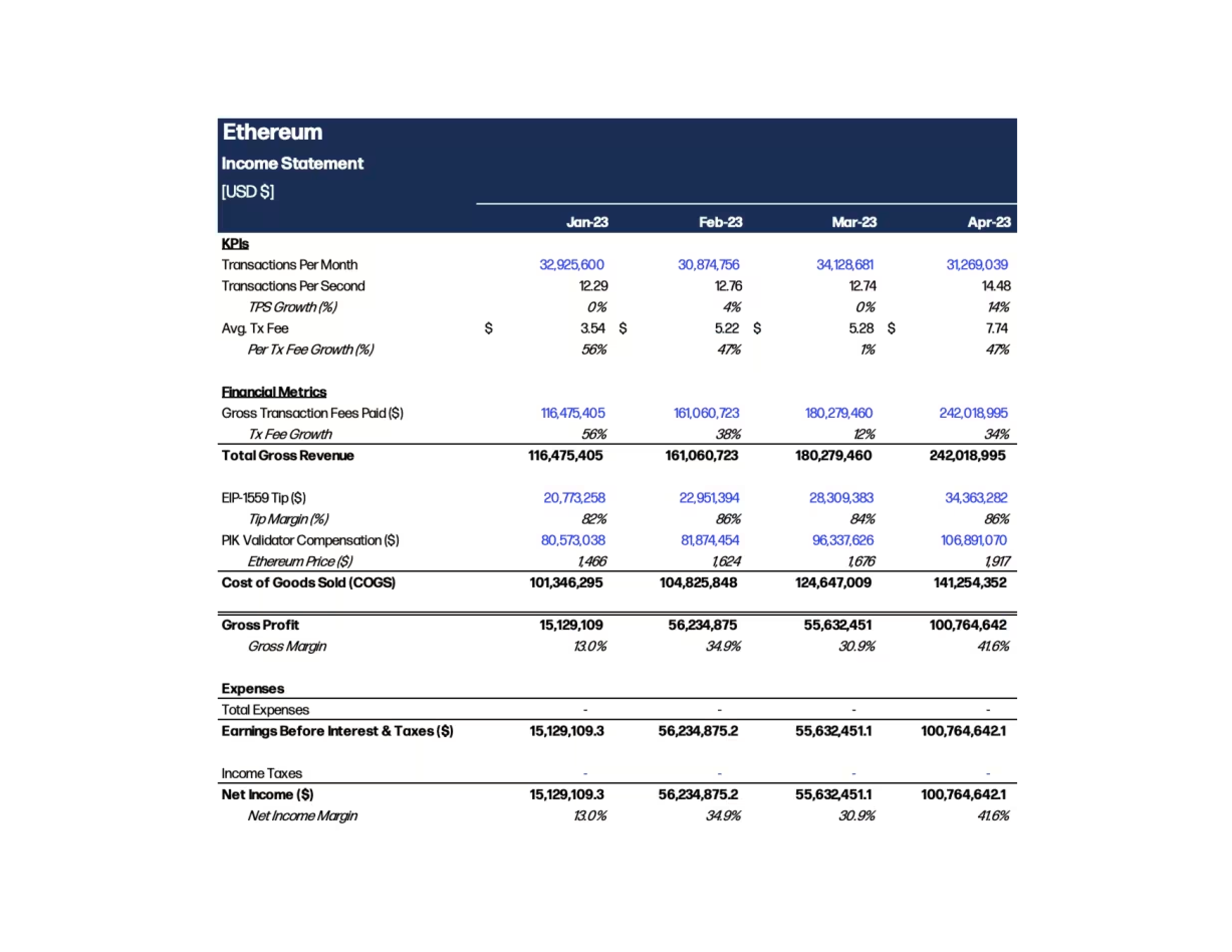

How the Equity Model gives ETH an income statement

Let's look at ETH's income statement under the Equity Model:

- Revenue = total transaction fees = base fees + priority fees

- COGS = in-protocol validator keep = total transaction fees + net issuance

- Gross profit = total transaction fees − (total transaction fees + net issuance) = −(net issuance) = burn

- Gross margin = burn / total transaction fees

(I'll be referencing Ethereum throughout, since it's most well-understood and has the most accessible metrics)

Coherent, detailed example ETH income statement from Galaxy Digital; interactive model here; loose, incoherent example here.

In the Equity Model, validator revenue is strictly an expense, and net burn is the only source of margin. This makes validators suppliers, users customers, and the protocol a middleman—it can only generate value that it captures in excess of validators.

Stepping back, traditional companies need cash flow to self-sustain their operations and invest in growth. Because a company's strategy only persists so long as it has margin to reinvest, equities must claim some intermediated value. When ETH is equity, it's required to capture margin within the bounds of the protocol—Ethereum the network becomes a margin-preserving intermediary to value, and ETH becomes a pro-rata share of Ethereum's margin.

Blockspace providers, however, have yet to successfully reinvest margin into new business value. In the case of ETH, all margin is burned. Consequently, whether or not the token's value flows through the protocol or gets captured off-chain is irrelevant (at least insofar as token value accrual is concerned), because captured value is just a means to simulate token demand, not create net new opportunities for the network. (In this sense, tokens could be considered synthetic capital assets? idk)

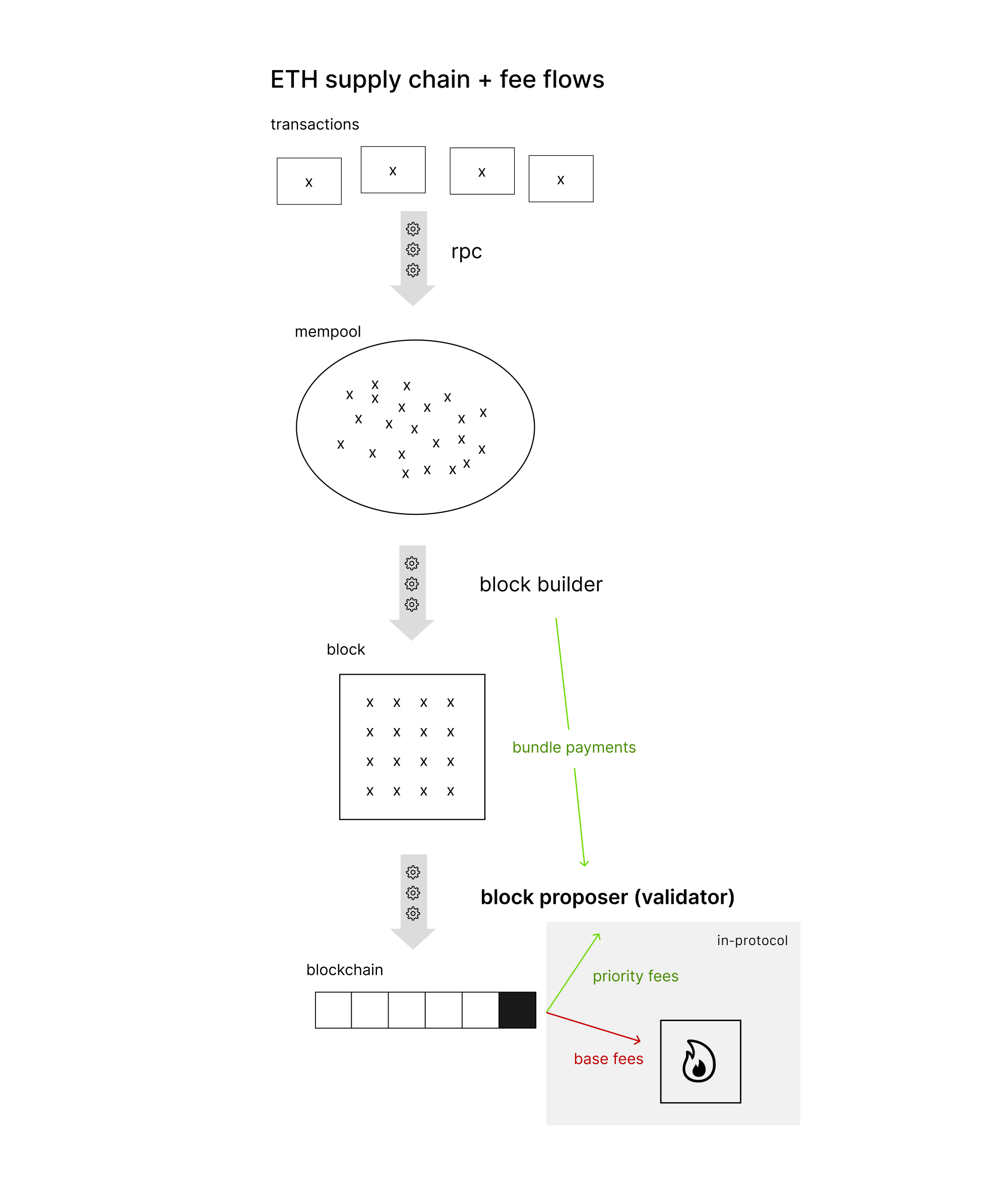

Fee flow refresher visualized alongside ETH's supply chain

Priority fees and MEV are not COGS

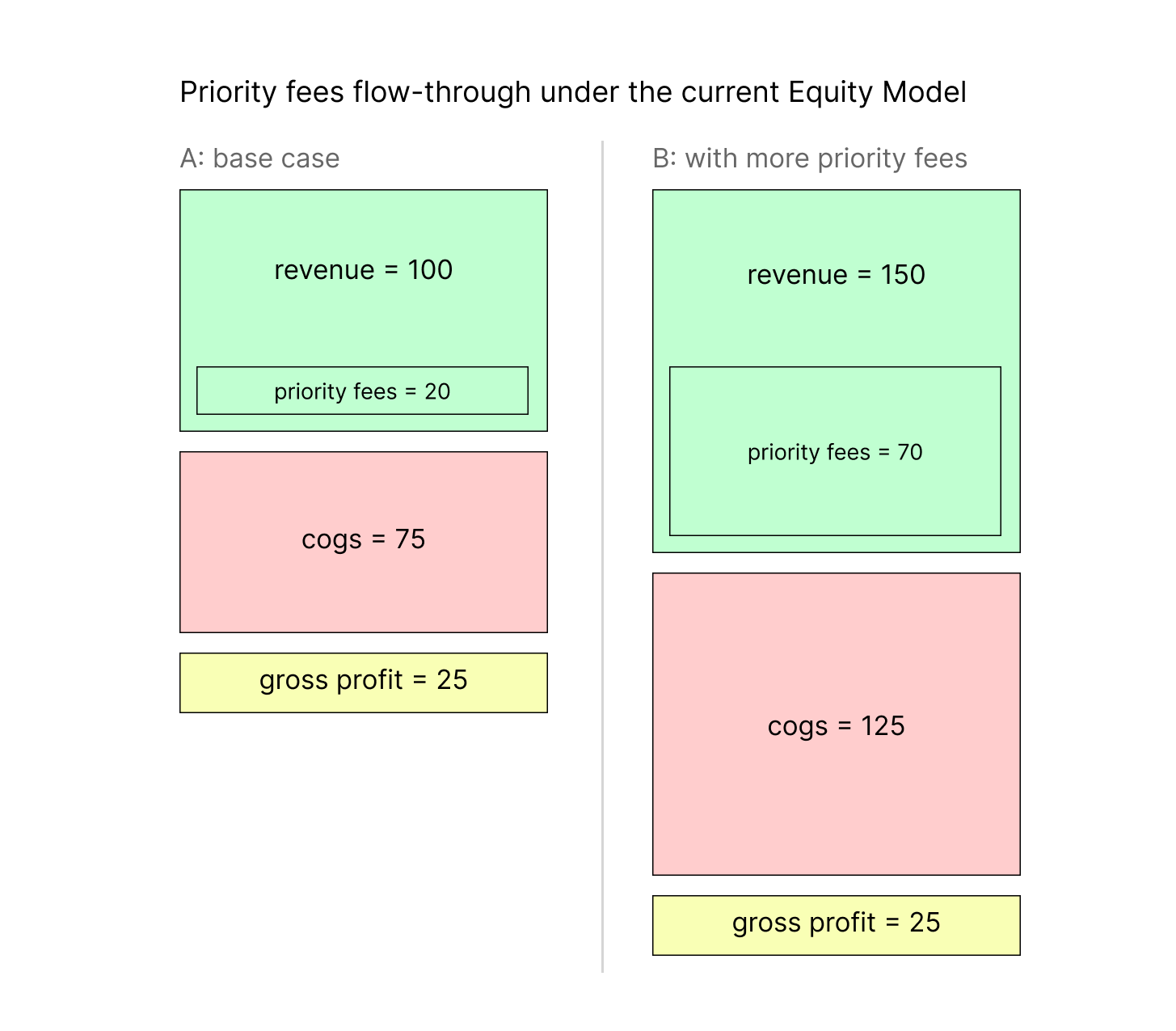

It's likely that the Equity Model makes the supplier/customer assumptions it does simply because they offer the best chance to show in-protocol margin. Regardless, because the model treats validators as suppliers, priority fees flow through the income statement as COGS. This means that, all else being equal, when priority fees increase, revenue goes up, margin goes down, and profits remain the same—on net, the token's value is unchanged. Here, if an L1 token doesn't have annual supply reduction it literally cannot have terminal value.

In the Equity Model, additional priority fees flow through the income statement as costs, so they have no effect on network profitability aka terminal token value

But, when priority fees increase, per-block validator revenue increases. For example, a block proposer with ~4500 ETH (~140 validators) is expected to propose ~1 block per day. If average per-block priority fees go up by 0.1 ETH, the block proposer captures an additional 36.5 ETH per year. As priority fees increase, the block proposer will pay additional dollars to propose the same number of blocks. Or, since the only way to propose more blocks is to own more ETH, the block proposer will pay more dollars for the same amount of ETH.

Priority fees raise the intrinsic value of ETH, but not in a way that's captured by the Equity Model, and in many cases, not in a way that affects value-flows through the protocol at all. Of course, validators participate in off-chain auctions where block builders pay them to propose specific, fully-ordered blocks. Total annualized, realized extractable value for validators in the first four months of 2024 on mainnet ETH is ~$949m, more than the total, in-protocol transaction fees of all L2s combined and about 23% of ETH's total transaction fees. This value is mechanically excluded from the Equity Model.

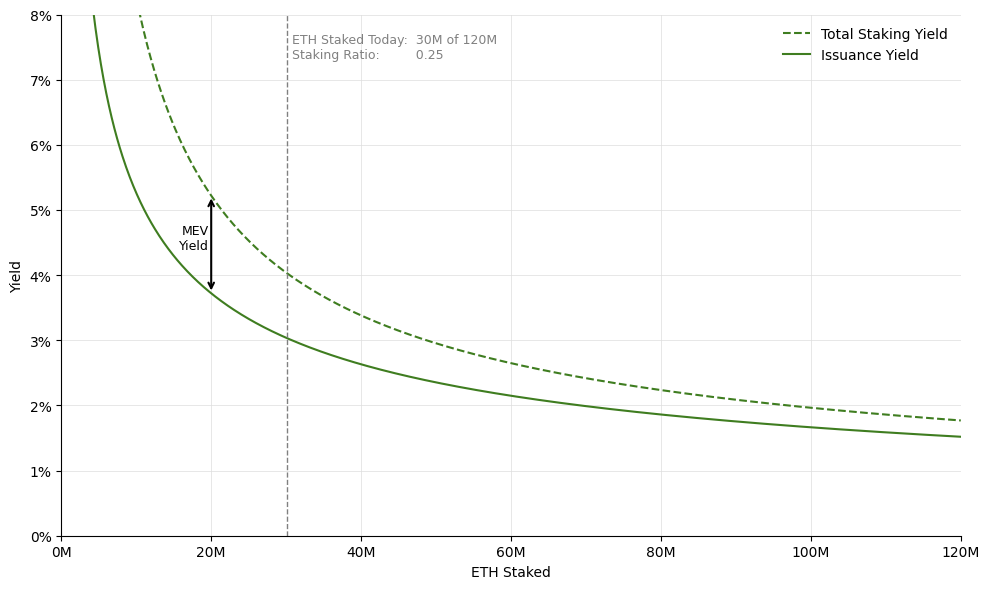

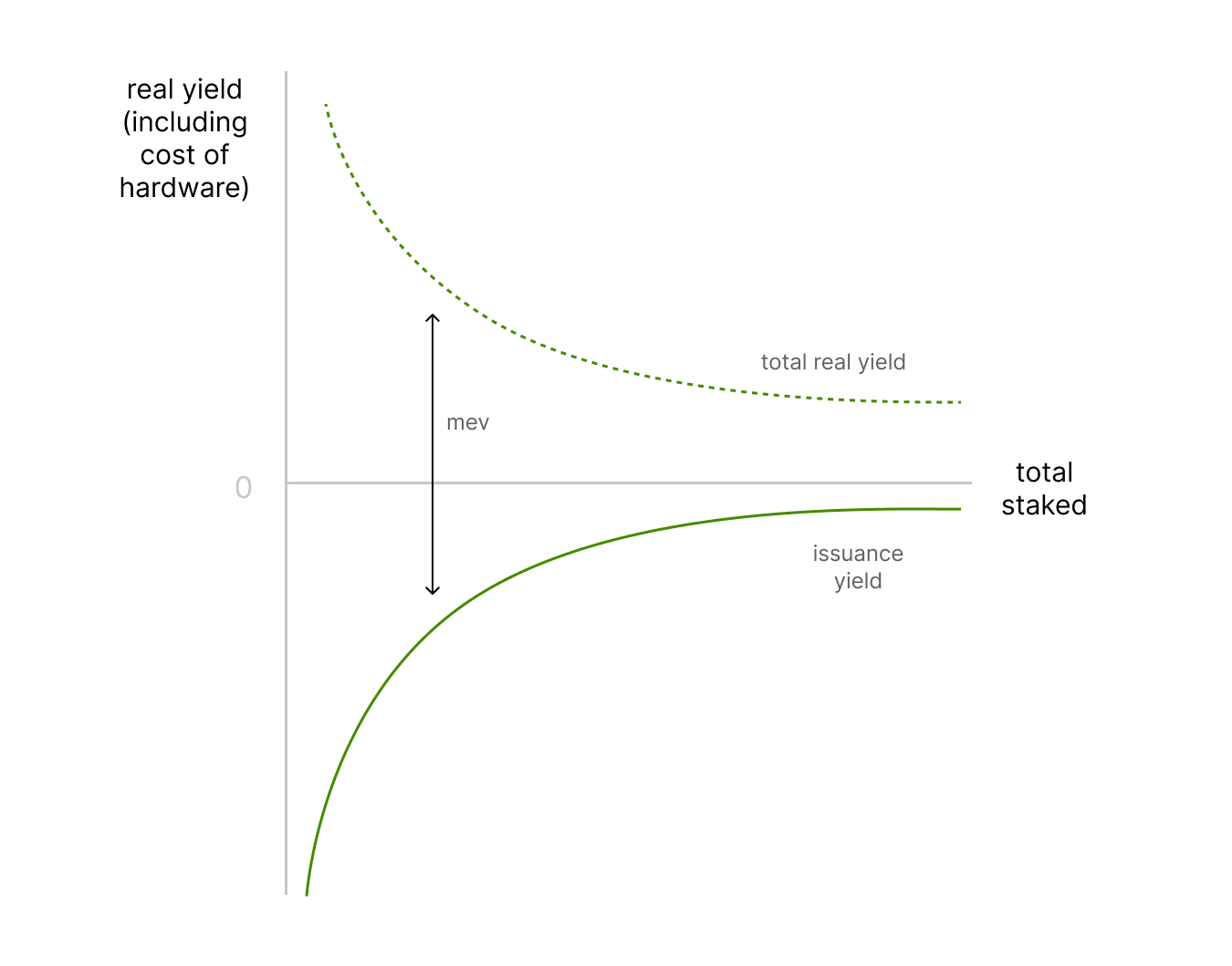

Current ETH issuance curve with and without MEV

My interest is not in arguing whether MEV should flow through the protocol (although there are proposed means to accomplish this), but to point out that additional MEV raises ETH's intrinsic value, regardless of the protocol's position as an intermediary, and therefore net burn.

It could be said that, more than anything else, a blockspace token's intrinsic value moves with the net present value (NPV) of its total future rights to block proposal. More abstractly, if ETH is equity, it's a fractional claim on the network's ability to capture value. If ETH is property, it's a fractional claim on the right to propose blocks.

(For simplicity, from here on out I'm going to bundle priority fees and MEV together as MEV. I know it's really REV but no one says that.)

MEV will be large and valuable on large and valuable networks

Okay, so marginal increases in MEV make it more profitable to propose blocks, which raises the intrinsic value of the token, since more tokens owned = more blocks proposed. What useful information does this tell us about the future?

I accept two assumptions:

- MEV is proportional to network scale

- #1 will hold in long-term equilibrium at negligible cost to users

Demand for relative execution is proportional to transaction volume

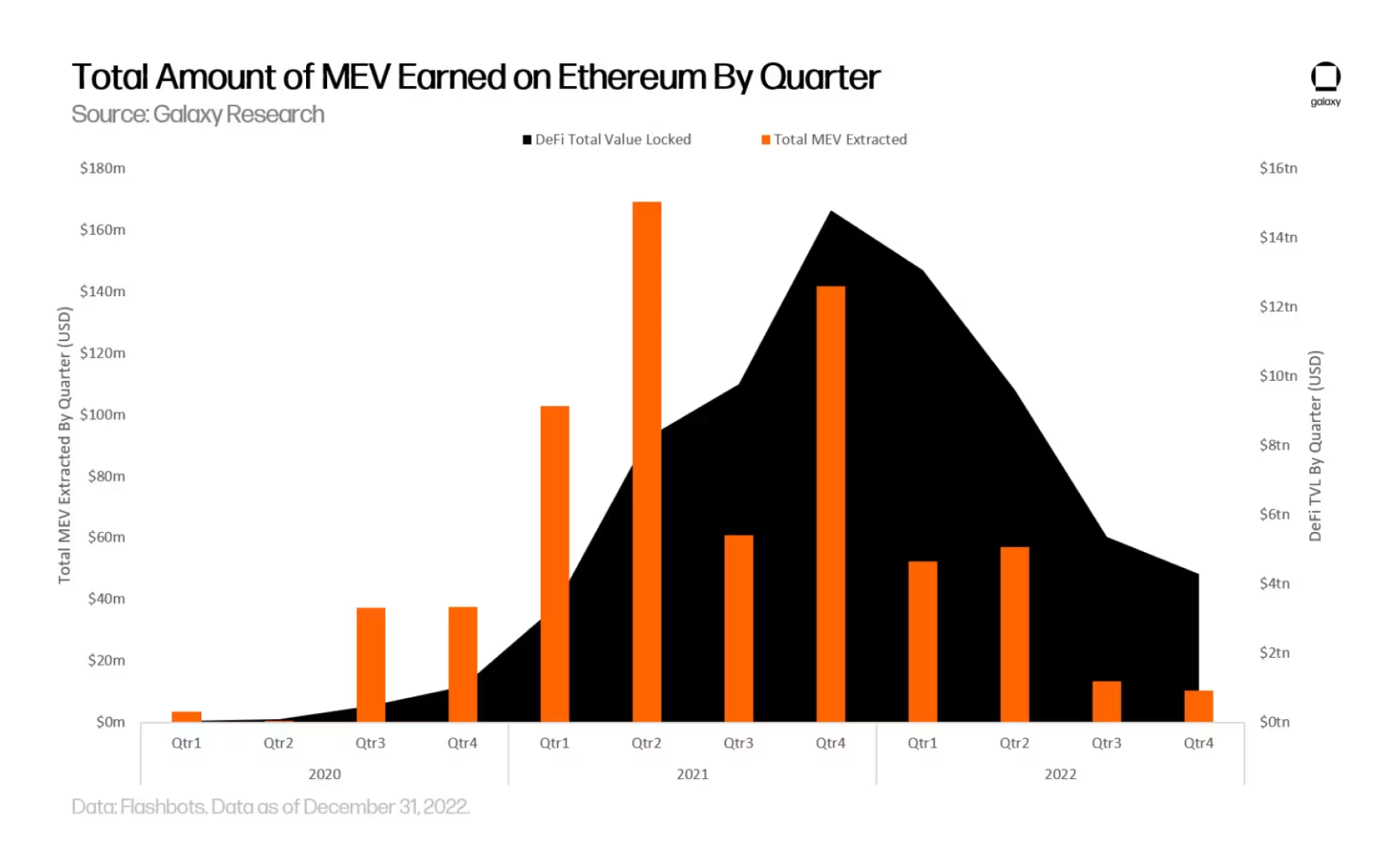

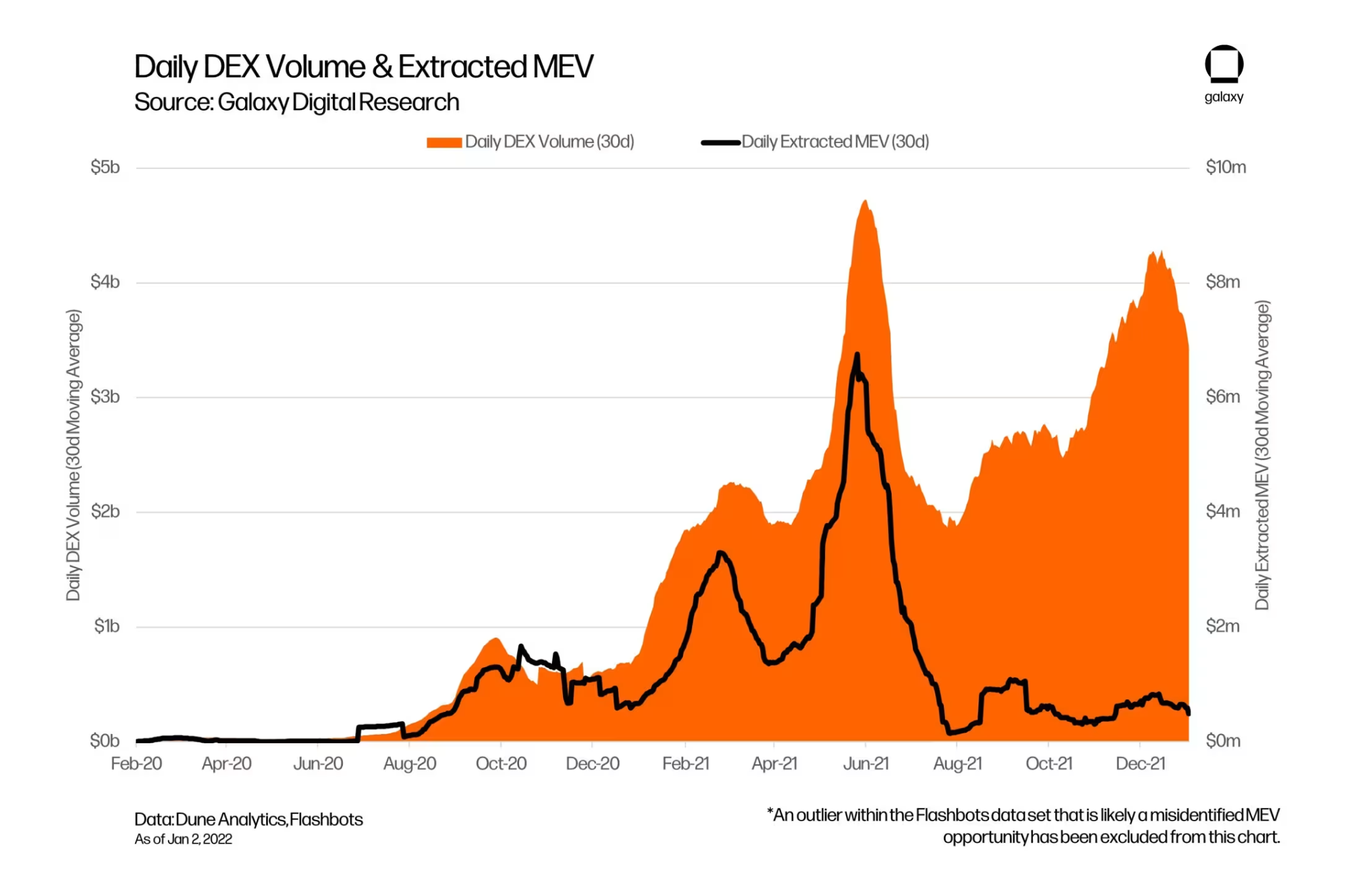

Classical MEV—mostly in the form of automated arbitrage—is historically highly correlated with TVL and DEX volume. In May 2021, when Ethereum's DEX volume doubled month-over-month to $118b, monthly MEV increased 3x to $38m. In March 2024, when ETH's DEX volume increased 78% month-over-month, monthly MEV increased 29% to $30m. (DEX vol, pre-merge MEV, post-merge MEV)

On-chain activity creates state drift, which creates arb opportunities, which creates demand for relative execution (MEV). Because validators have a monopoly on block proposal, block-builders should theoretically be willing to pay validators up to the full expected value of an opportunity to capture it.

The charts below show the relationship between MEV extracted on Ethereum and TVL / DEX volumes. (Note: In the DEX volume graph, the second half of 2021 is missing MEV from Uni V3, hence the dropped correlation.)

MEV moving with TVL

MEV moving with DEX volume. The second half of 2021 data is missing MEV from Uni V3, hence the dropped correlation.

MEV will remain strong in long-term equilibrium at negligible cost to users

It's often assumed that MEV will degrade as blockspace matures. However, although plenty of MEV-protective tools have launched in the last year, year-on-year MEV as a percentage of DEX volume in the first quarter of 2024 has actually increased 117% compared to Q1 2023, jumping from $0.70 per $1k DEX volume to $1.51 (maths). Certainly some of this could be attributed to changes in off-chain volume, but the data supports the more abstract promise that participants in financial markets have varying relative execution preferences and will pay to express them.

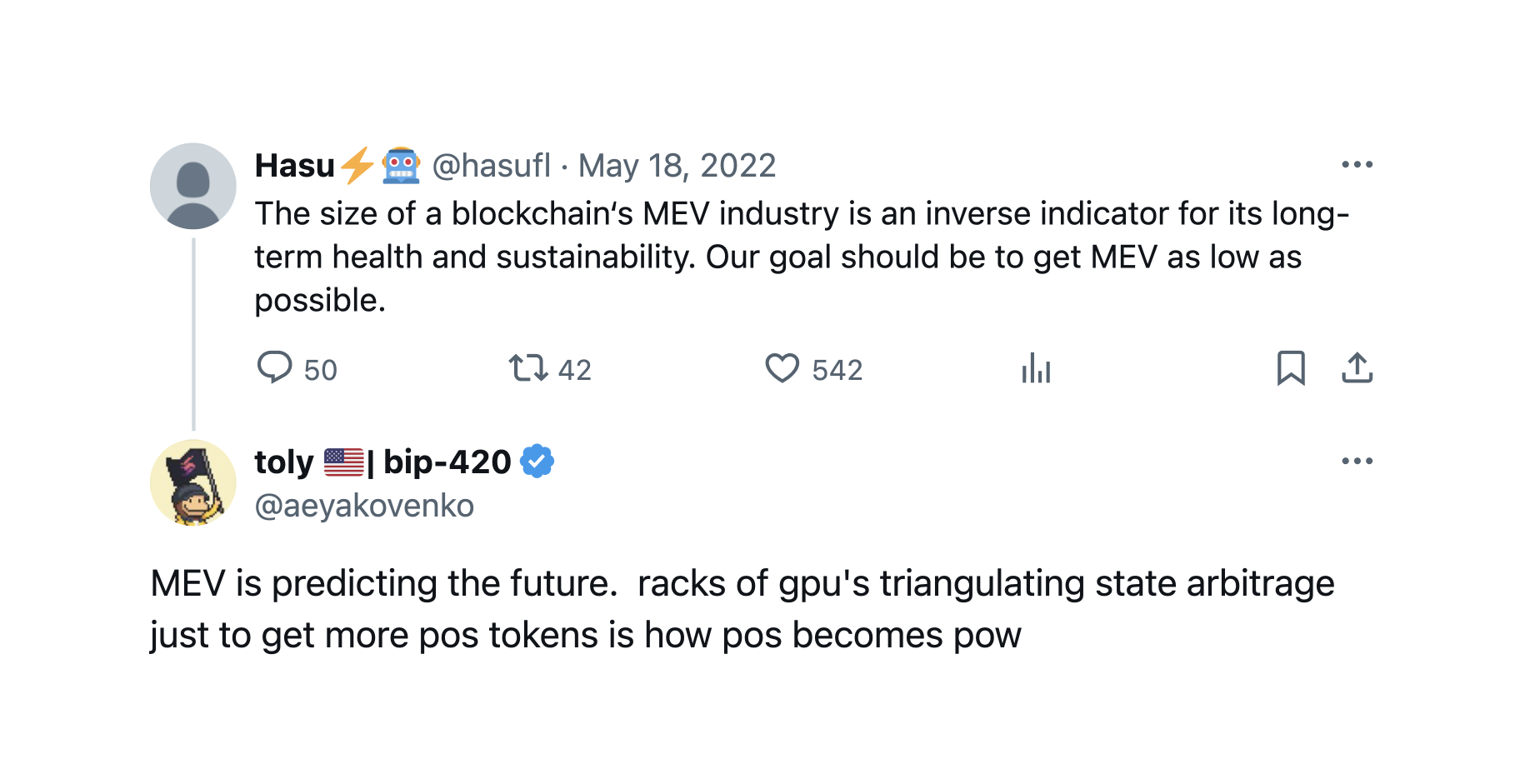

Hasu and Anatoly exchange

In traditional HFT, a common area of focus is index rebalancing. When facts about a company change (e.g., their market cap), their index eligibility changes. Equities that get added to large indicies (e.g., S&P 500) experience new demand, because mutual funds and ETFs that track the indicies need to buy them—traders that successfully predict these changes can front-run the market's reaction and take profits.

Index rebalancing is both extremely time-sensitive and nondeterministic. S&P Global literally has a committee that decides which companies get added to the S&P 500. Unlike atomic MEV that carries no execution risk, trading changes to the S&P requires predictive models that can return the wrong answers.

Large, active financial markets have lots of these types of information cascades that open up windows of opportunity to express beliefs about the market. When someone wants to express a market belief that only has positive EV given a specific market state, they will pay to express it before anyone else.

MEV lets users pay to get transactions executed in an order that aligns with their beliefs. Often, whether or not those beliefs are correct is unknowable; their success or failure isn't as simple as arbing across DEX markets. This is the source of MEV's durability. As long as the value of relative execution is unknowable at the time of block production, it cannot be returned to end users. Here, long-run MEV is not a drag on network health, but a form of price discrimination on execution urgency.

Monetary policy is a tool to manipulate validator profitability

In a future with infinite, commodified blockspace, transaction-fee premiums will stagnate or disappear, but MEV will grow proportional to adoption, making it likely that large, successful networks will increasingly rely on MEV for validator profitability. To put it very generally, large network scale with proportional MEV and cheap compute is a much stronger equilibrium than smaller network scale, proportional MEV, and expensive compute, as the first is more adaptive to high demand in the face of substitutes.

In these economies, net supply changes are a means to transfer wealth back and forth between stakers and (unstaked) token-holders for the sake of macroeconomic goals. Net inflation to validators shifts wealth from token-holders to stakers. Net deflation from burnt transaction fees shifts wealth from stakers to token-holders. Networks should choose whatever monetary policy maximizes the NPV of future rights to block proposal, but neither is proof of terminal token value or lack thereof.

One could imagine a future where the underlying hardware/networking costs of reaching consensus are so low that—even with negligible, at-cost txn fees—a network decides to reverse standard monetary policy and implement negative issuance curves, charging validators to propose blocks and distributing the revenues to unstaked token-holders. This would not be accurately viewed as an infinite money glitch where fees / (fees + unstaked yield) = margin. It would simply be a corrective measure for the network's economy to shift wealth to unstaked tokens relative to staked, likely either to stimulate demand for compute or to boost the token's use as a medium of exchange.

An entirely fabricated negative issuance curve, visualized

In the long run, validators are customers

What's the correct way to model the relationship between stakers, token-holders, and the protocol?

The core value prop of decentralized, cryptoeconomic protocols is that they can build and coordinate value without intermediating it. Any model that requires the protocol to take margin in excess of validators and do absolutely nothing with it is likely to be evolutionarily unfit, as it's adversarial to validators and the costs are ultimately passed on to buyers of compute (users).

Again, there are circumstances where shifting value to unstaked token holders makes sense for long-term network health, but no model should ignore validator profitability and use achieved deflation to measure terminal token value.

Revisiting L1 value chains, it's most appropriate to consider the protocol (i.e., the code) as the network's raw materials (COGS) and its validators as customers. Here, validators pay the protocol (buy tokens) in order to propose blocks, and users pay validators for blockspace. The protocol's job, it follows, is to create the most durable relationship between validators and users, so that validators can keep paying more and more money to propose blocks.

Of course, this perspective renders MEV increasingly important when modeling token value, since it's a core driver of validator profitability, particularly in the absense of compute-scarcity fee premiums. In a future with infinite blockspace and corresponding demand, it's likely that protocols will internalize MEV value flows to have more control over their structure and render them more legible to the investing public.

Related links:

- https://collective.flashbots.net/t/modelling-realised-extractable-value-in-proof-of-stake-ethereum/290

- https://dba.xyz/eth-is-not-ultrasound-money/

- https://www.michaeldempsey.me/blog/2024/02/29/expected-value-in-crypto-building-infinite-blockspace/

- https://uncommoncore.co/a-deductive-valuation-framework-for-cryptocurrencies/

- https://mirror.xyz/electriccap.eth/SD0wT7qSSfis9gLT_Ki1gY6_oTYEqgwcGE0hDw7kMDY