My personal memecoin idea maze

July 15, 2024

My primary interest is in developing stable modes of value accrual for non-protocol tokens. I believe tokens are a powerful attention technology and that there exists some combination of infrastructure that offers them simple, robust economic models—with which they will accelerate culture.

A near-term way that to think about this is: "What's the canonical business model for token communities whose core competency is not shipping proprietary software?" Right now, these communities exist most prominently in the form of memecoins, of which I consider Bitcoin the foundational example, as its value is primarily derived from cultural significance as opposed to services rendered.

Here, I offer some background on why I feel this is such an interesting design space and briefly catalog where it's taken me over the past few months using a maze diagram.

Tokens are easy to pay attention to

Blockchains offer a few key features:

- Token issuance

- A robust environment for programs that compute over token state

As you've probably heard, people are excited about using these features to bring existing capital markets on-chain. While I agree this will eventually happen, there's no catalyst for it. Any capital market that already exists, by definition, does not need to exist on-chain. RWAs today are 0.5% of total token market cap. On its current course, this transition will take a long time.

Meanwhile, many crypto-native markets support prices and volumes far and above any coherent model of their underlying tokens. Anyone with a brain can scroll through coinmarketcap and point to several effectively dead projects with nine and ten figure market caps. There are bad reasons for this—fog, fraud, and hope—but there are also good reasons.

The relationship between tokens and traditional financial instruments has strong parallels to the relationship between internet-native media and institutional media. Video content filtered through a Hollywood studio is more polished, safe, and investment-ready than the biomass of Youtube and Tiktok. But, it comes with reduced entropy and greater distance from the viewer.

Marvel versus internet

One generally cannot tank the value of an institutional asset by getting into a fight with its creator on Twitter (Tesla notwithstanding). Tokens make few promises but pass financially-consequential drama to investors' screens in real-time via the public internet. This is not a temporary consequence of market maturity; it follows from technology—tokens can be issued and purchased by anyone, anywhere. This makes them more expressive, more reflexive, and more engaging than their traditional counterparts.

If you have something to say just say it

Searching for a foundational model of memecoins

For my purposes, memecoins are tokens which succeed primarily by organizing attention as opposed to rendering a product or service. Importantly, many of today's largest consumer-facing companies, if organized on-chain, would be memecoin issuers under this definition.

mapping Tokens x Attention

Of course, how tokens accrue value goes hand in hand with how they're used. It might seem paradoxical to start by considering economic models and then work backwards into product experiences. My motivation for doing so is the belief that memecoins are primarily constrained by economic structure as opposed to product adaptation. If memecoins can access robust modes of value accrual, it will be (relatively) easy to build engaging product experiences around them.

Under this logic, token communities do not need to morph into complex, on-chain businesses. They just need a sort of basic, internet-native feedback loop that's widely understood and captures value.

I'm sure that I should add more background, but I'm moving on (message me).

How do memecoins accrue value?

The maze begins with a simple but sort of heady idea: Bitcoin bootstrapped store-of-value by empowering a techno-libertarian social movement. Maybe new memecoins could succeed similarly with different identity groups? (token + values)

This lead me to a few next-level questions:

- How do memecoins maintain identity in the face of speculation?

- Is identity-alignment enough to create large-scale value accrual?

- Does it make long-run sense for memecoins to monetize attention directly via market demand?

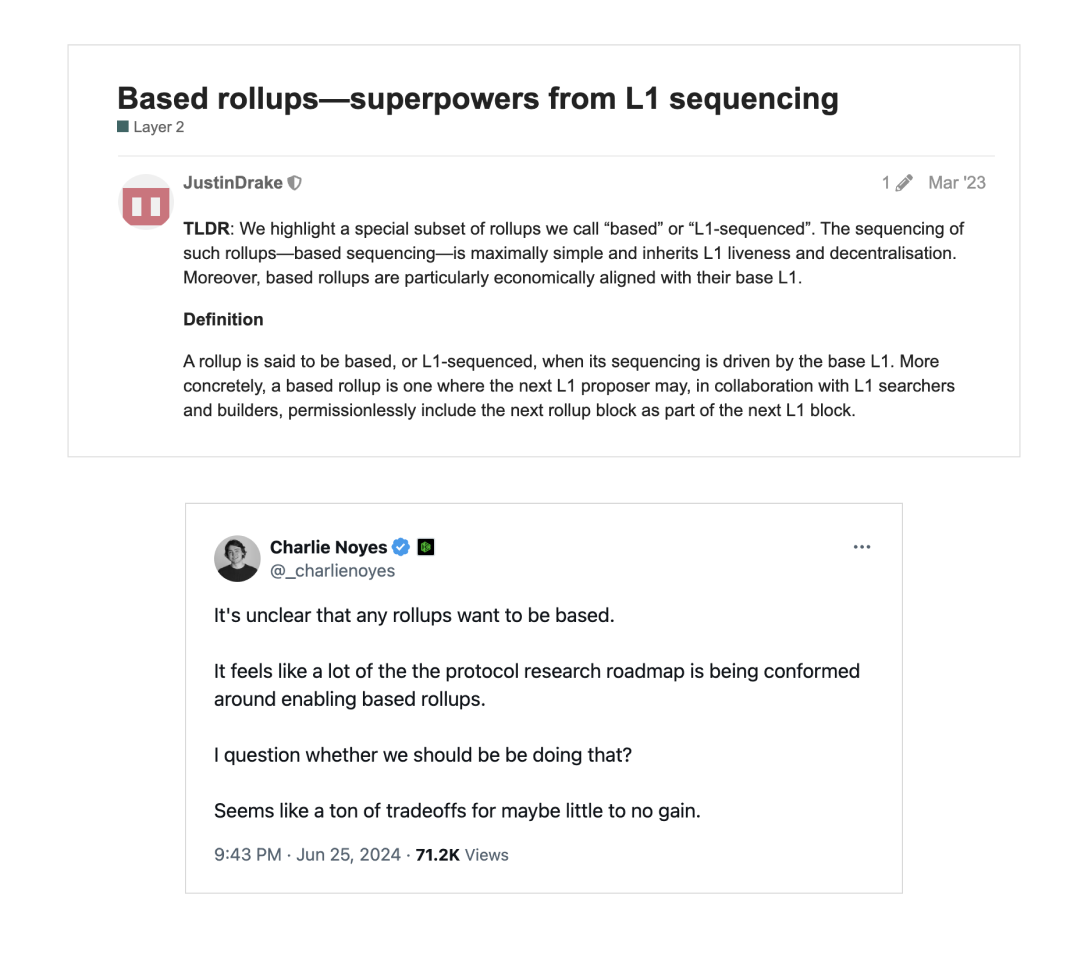

I decided to try writing this in a visual format. I do think it better represents the evolution. To view the maze, click on the image below.

Memecoins aren't immune to accounting

I began with the assumption that existing memecoins mostly work and tried to generate economic models that support them. While there are interesting things to be said there, it's much more likely that memecoins find modes of concrete value capture than that investors squint to accommodate their present form. New stores of value, though they're interesting and can fit in a coherent model, are not that value-accretive.

In a future where tokens provide distribution to publishers in exchange for a cut of ad revenues, relevance is a multiple on value capture, not a substitute for it. This is just how everything else works.

Message me.